Creating an Entrepreneurial Small Business

Subtopic:

Partnership

A partnership is a form of business where ownership and management are shared between two or more individuals.

Key characteristics include:

Shared Profits and Losses: Partners jointly participate in the financial outcomes of the business, dividing both gains and deficits. This arrangement defines the relationship between individuals who’ve agreed to distribute business profits.

Membership Size: Typically involves a minimum of two and can range up to twenty partners. An exception exists in banking, where legal limits often restrict partnerships to a maximum of ten members.

Legal Framework: Governed by a formal partnership agreement or legal statutes pertaining to partnerships within Uganda.

Types of Partnerships:

There are primarily two classifications of partnerships, distinguished by the level of liability partners assume:

General Partnership:

All partners in this structure carry unlimited liability. This means their personal assets are at risk to cover business debts and obligations.

Limited Partnership:

Features two classes of partners with differing liability:

General Partners retain unlimited liability, responsible for business debts beyond their investment.

Limited Partners benefit from limited liability, meaning their financial risk is typically restricted to the amount they have invested in the partnership.

Examples of Partnerships:

A legal practice established and run by multiple lawyers.

A construction firm owned and operated by a team of individuals.

A retail business owned and managed by two or more persons.

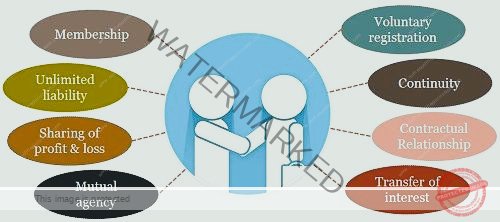

Key Features of a Partnership:

Membership Range: Partnerships are established with at least two individuals and can include up to twenty members in most cases.

Capital Contribution: Funds to start and operate the business are provided by all partners, often according to a pre-decided ratio.

Profit and Loss Distribution: Earnings and losses of the partnership are divided among partners in proportions they have mutually agreed upon beforehand.

Mutual Agency: Actions and commitments made by one partner on behalf of the partnership are generally binding on all other partners.

Shared Management Responsibility: The workload and duties of managing the business are typically distributed among the partners.

Liability Structure: Generally, partners have unlimited liability unless a partnership deed explicitly states otherwise, meaning personal assets can be at risk.

Ownership Changes: Transferring ownership or bringing in a new partner requires agreement from every existing partner in the partnership.

Establishing a Partnership:

Formation by Agreement: A partnership comes into existence through a mutual understanding between individuals, which can be formally documented or simply agreed upon verbally.

Partnership Agreement (Deed): When creating a partnership, partners usually formalize their understanding in a written document. This formal agreement, known as a partnership deed or partnership agreement, lays out all the terms and rules governing their business relationship.

Contents of Partnership Deed

Firm’s Name: The official title designated for the partnership business.

Partner Details: Complete names and current residential addresses of all participating partners.

Business Scope and Location:

Type of business activities the partnership will engage in.

Geographic address where the business operations will be based and conducted.

Partnership Start Date: The precise date from which the partnership officially commences its business activities.

Partnership Term (if applicable): The specific duration or time frame for which the partnership is intended to operate, if predetermined.

Capital Contribution by Partners:

Amount of funds or assets each partner has contributed or is expected to contribute to the partnership.

Specification on whether the capital accounts will be maintained at a fixed amount or allowed to fluctuate.

Bank Account Operations: Guidelines and rules outlining how the partnership’s bank accounts will be managed and operated, including who is authorized to operate them (individually or jointly).

Contents of a Partnership Deed

A partnership deed is a critical, legally enforceable document that defines the framework of a business partnership. It usually includes the following details:

Business Nature: Clearly states the specific type of business the partnership will engage in.

Capital Structure: Specifies the total capital investment needed for the firm and the agreed-upon proportion each partner will contribute.

Profit and Loss Sharing: Defines the agreed ratios or percentages in which profits and losses will be distributed among the partners.

Interest on Capital and Drawings: Outlines if partners will receive interest on their capital contributions and if interest will be charged on any funds they withdraw (drawings).

Anticipated Drawings: Specifies the permissible amounts partners can withdraw from the business in advance of actual profit calculation.

Partner Salaries: Details if partners will receive a regular salary for their work in the partnership, and if so, the amounts.

Accounting and Auditing Procedures: Describes how financial records will be maintained, the accounting practices to be followed, and the process for auditing the firm’s accounts.

New Partner Admission: Sets out the rules and procedures for admitting new partners into the partnership in the future.

Partnership Duration: Indicates the intended length or term of the partnership agreement, whether for a fixed period or ongoing.

Handling Partner Issues: Establishes regulations and procedures to be followed in case a partner faces significant issues like death, incapacitation (insanity), or other unforeseen problems.

Advantages of Partnership

Partnerships offer several benefits for businesses compared to sole proprietorships and even corporations in some aspects:

Increased Capital Pool: Partnerships can accumulate more startup and operational funds because they draw on contributions from multiple individuals (up to 20), unlike a sole trader.

Diverse Skill Sets: Combining individuals with varied skills creates a broader range of expertise within the business. This encourages specialization and can lead to more innovative solutions.

Reduced Work Overload: Responsibilities can be shared among partners, preventing any single individual from being overburdened. This distribution of work makes management more sustainable.

Improved Borrowing Power: Partnerships often find it easier to secure loans from financial institutions or credit from suppliers due to the combined financial strength and reputation of multiple partners.

Simple Formation Process: Setting up a partnership is relatively straightforward with minimal legal formalities, primarily requiring a partnership agreement and registration in many places.

Collaborative Problem Solving: Partners can engage in joint discussions to address business challenges and find solutions collectively, offering diverse perspectives which a sole trader lacks.

Expansion Capability: Partnerships can more readily expand their business operations because they have the option to bring in new partners, injecting fresh capital and expertise when needed.

Shared Risk and Liability: Business losses and debts are distributed among all partners, reducing the financial strain on any single individual compared to a sole proprietorship.

Business Continuity: Partnerships have a greater chance of surviving beyond the involvement of a single individual. The death or retirement of one partner is less likely to cause immediate business collapse, ensuring better continuity.

Privacy in Finances: Partnerships generally are not legally obligated to publicly disclose their financial accounts and reports, allowing for greater confidentiality of business operations.

Easy to Establish: Formation is usually less complex than setting up a corporation.

Flexible Management: Decision-making processes can be more adaptable and less bureaucratic than larger corporations.

Larger Funding Capacity: Access to combined capital from multiple partners allows for greater financial strength.

Distributed Risks and Skills: Spreading business risks and leveraging the collective abilities of partners can enhance stability and capability.

Potential Longevity: Partnerships may have a longer lifespan compared to sole proprietorships due to shared responsibility and broader expertise.

Faster Decisions: Decision processes can be quicker than in larger, more hierarchical companies.

Wider Management Base: A larger pool of management talent is available, as each partner brings unique skills and perspectives.

Legal Recognition: Partnership agreements, when formally documented, are recognized and protected under the law.

Job Creation: Partnerships, like other businesses, contribute to the economy by creating employment opportunities.

Limitations/Disadvantages of a Partnership

Despite the advantages, partnerships also have notable drawbacks:

Unlimited Personal Liability: In most partnerships, partners face unlimited liability, meaning their personal assets can be used to settle business debts, posing a significant financial risk.

Impact of Partner Actions: Poor decisions, errors, or unethical conduct by one partner can have negative financial and reputational repercussions for all other partners, as they are jointly liable.

Potential for Slow Decision-Making: The requirement for consensus among partners for major decisions can slow down the decision-making process and potentially cause missed opportunities, especially time-sensitive ones.

Disagreements and Conflicts: Partners may have differing opinions and approaches to business issues, leading to disagreements that can hinder business progress and sometimes even dissolve the partnership.

Unequal Effort vs. Shared Profit: When profits are shared equally, partners who work harder may feel demotivated if their efforts are not proportionally rewarded, potentially reducing individual incentive to excel.

Restricted Ownership Transfer: Partnership interests or shares are not easily transferable. Selling or transferring a share to someone outside requires unanimous consent from all existing partners, limiting liquidity.

Dependence on Key Partners: Partnerships can be overly reliant on the skills and contributions of a few key partners. The departure or loss of a critical partner can destabilize or even lead to the collapse of the firm.

Kinds of Partners

Partnerships can involve different types of partners, each with varying roles, responsibilities, and liabilities:

Active Partners (Working Partners): These partners are actively involved in the day-to-day management and operations of the business. They contribute capital, share in profits and losses, and bear liability for the firm’s debts. Example: Partners in a construction company managing projects and daily operations.

Dormant Partners (Sleeping Partners): Also known as silent partners, they primarily contribute capital to the business and share in profits and losses but do not actively participate in daily operations. However, they still hold liability for the firm’s debts. Example: An investor in a retail store who provides funds but is not involved in running the store.

Nominal Partners (Quasi Partners): These partners lend their name or reputation to the firm, often for goodwill or marketing purposes. They typically do not invest capital, share in profits, or actively manage the business, but they can still be held liable to third parties for the firm’s debts. Example: A celebrity who allows a clothing store to use their name for promotional value.

Minor Partners: These are individuals under the legal age of majority (e.g., under 18). While generally ineligible to be full partners, they can be admitted to a partnership in certain jurisdictions, primarily to share in profits. Their liability is usually limited to their capital contribution, and their decisions are not legally binding. Example: A minor joining a family business, primarily benefiting from profits.

Partners by Estoppel (or Holding Out): An individual who is not actually a partner but behaves or represents themselves in a way that leads others to believe they are a partner can be held liable as one. This is especially true if third parties rely on this representation in business dealings. Example: Someone falsely claiming to be a partner in a law firm and acting as such, can be liable for actions as if they were a real partner.

Sub-partners: This is not a partner in the main partnership firm itself but rather an individual who has an agreement with an actual partner to share in that partner’s profits from the partnership. The sub-partner has no direct relationship or liability to the partnership firm itself. Example: Someone who privately agrees with a partner in a catering business to receive a portion of that partner’s profit share.

General Partners (in Limited Partnerships): In the context of limited partnerships, general partners have unlimited liability for the firm’s debt and typically manage the business operations. Example: In a limited partnership structure, the managing partner of a construction company who carries full liability.

Rights of a Partner in a Partnership Business:

Management Participation: Right to be actively involved in the daily running and management of the partnership.

Decision Consultation: Right to be consulted on all matters affecting the partnership and to have their voice and opinions heard in decision-making processes.

Account Access: Right to inspect the partnership’s financial records and books of accounts, and to obtain copies for review.

Profit Sharing: Right to receive a share of the partnership’s profits, typically divided equally among partners unless a different ratio is agreed upon in the partnership deed.

Interest on Capital & Advances: Right to be paid interest on the capital they have contributed to the partnership and on any loans or advances made to the firm, if agreed upon.

Indemnification: Right to be compensated (indemnified) by the partnership for any personal payments made, liabilities incurred, or losses suffered on behalf of the firm in the course of legitimate partnership business.

Use of Partnership Property: Right to use partnership assets and property for the benefit of the business only and not for personal gain.

Agency Right: Right to act as an agent of the partnership and to make binding agreements and commitments on behalf of the firm, within the scope of their authorized actions.

Continuity of Partnership: Right to remain a partner in the business and expect the partnership to continue, unless specific conditions for cessation are met as outlined in the partnership deed or by mutual agreement.

Retirement Rights: Right to retire from the partnership with the consent of other partners and according to the terms specified in the partnership deed regarding retirement procedures and payouts.

Outgoing Partner/Heir Rights: Right, or for their legal heirs, to receive benefits and entitlements as an outgoing partner (in case of retirement) or as the heir of a deceased partner, as per the partnership agreement and relevant laws.

We are a supportive platform dedicated to empowering student nurses and midwives through quality educational resources, career guidance, and a vibrant community. Join us to connect, learn, and grow in your healthcare journey

Quick Links

Our Courses

Legal / Policies

Get in Touch

(+256) 790 036 252

(+256) 748 324 644

Info@nursesonlinediscussion.com

Kampala ,Uganda

© 2025 Nurses online discussion. All Rights Reserved | Design & Developed by Opensigma